The Young Musicians Foundation, The Legacy Continues

The Young Musicians Foundation, The Legacy ContinuesC U L T U R A L W A R F A R E!

A Fiery Roundtable

A Brilliant Concert

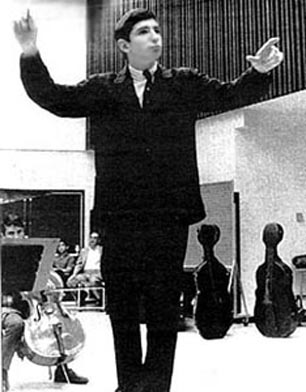

The Young Musicians Foundation and its Debut Orchestra, led by music director and conductor, Maestro Case Scaglione, present “Cultural Warfare,” a concert performance and what promises to be a lively roundtable dialogue. The Debut Orchestra’s first performance takes place Sunday, March 14 at the Broad Stage, 1310 11th Street, Santa Monica, 4:00 p.m. This will be followed by a performance on Monday, March 15 at Hollywood’s Helen Bernstein High School, 1309 N Wilton Place, Los Angeles, CA 90028 at 1:30 p.m.

As part of its Outreach Concert Series the Young Musicians Foundation (YMF) along with its world-famous Debut Orchestra, has set out to revolutionize the way music is presented to young people by bringing together classical scores and an interactive presentation that includes provocative visuals and spirited conversations about pop culture, art, and current events, infused with music history and appreciation, literature.

To provide more than just an extraordinary listening experience, Maestro Scaglione and YMF Artistic Administrator Dr. Mieko Di Sano will use innovative slides, videos, and music examples to get across the imagery. Students will discuss how the current societal norms compare to the events and culture that produced pieces like Pärt’s Fratres for Violin & Strings in the late 20th century (Sunday) and Brahms’ Symphony No. 4 in E minor in the late 19th century (Monday).

“We have a moral obligation as classical musicians in the modern era to bring our splendid art form to tomorrow's generation,” said Maestro Scaglione. “If the young people in our cities and towns are not tirelessly sought out we cannot expect them to understand the magnitude and importance of what we do. I can think of no better introduction to Western Art Music than an open, interactive discussion with the youth of Los Angeles. This will be a wonderful opportunity not only for our young audience

as a learning experience, but for us to rediscover why we fell in love with classical music to start with.”

The concert series is underwritten with generous funding from State Farm Insurance, and partners with Teach for America.

YMF’s concerts not only prepare young players for their life as professional musicians, but also allow YMF to bring great music to the people of Southern California for free. With the generosity of corporate underwriting, YMF continues to expand that tradition so that every child, regardless of race or socio-economic standing, can be taken to those magical places visited only through great music.

For more information visit the Young Musicians Foundation’s website at www.ymf.org or call 310-859-7668.